Tag: 2020 Election

I Voted

Dueling Town Halls

It struck me, while watching the dueling town hall events, how normalized it has become that the national news talks about the president every.single.day. I get that it’s news because he’s the president … but, for most of American history, the president did his thing. Some people didn’t agree with his choices, some did. But it wasn’t so outrageous as to warrant being broadcast to the entire country on the national news. I don’t mean the cable-news plenty-of-time-to-fill stations — I mean the half hour daily news on the national networks.

Ohio Absentee Ballot — Confirming Rejected Ballot

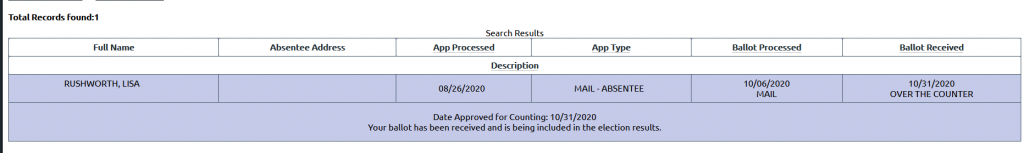

I requested an absentee ballot this year — we’d used absentee ballots once back when we lived in Geauga county and delivered the ballots to the Board of Elections office, but we generally vote in person. I wanted Anya to experience the process (and they give out cute stickers!). But we’ll have more time to explore what the ballot actually is at home, and there won’t be a bunch of people about. But — and the one thing that makes me want to do the early in-person voting — they can reject your ballot if the signature doesn’t match. I didn’t have a problem with my absentee ballot request, but Scott’s got rejected for a signature mismatch. And that had be worried about my actual ballot.

But, amid all of Trump’s blathering last night? Biden managed to convey that a lot of states have a process for curing rejected absentee ballots. I had no idea. Per Ohio Rev Code § 3509.06:

“(b) If the election officials find that the identification envelope statement of voter is incomplete or that the information contained in that statement does not conform to the information contained in the statewide voter registration database concerning the voter, the election officials shall mail a written notice to the voter, informing the voter of the nature of the defect. The notice shall inform the voter that in order for the voter’s ballot to be counted, the voter must provide the necessary information to the board of elections in writing and on a form prescribed by the secretary of state not later than the seventh day after the day of the election. The voter may deliver the form to the office of the board in person or by mail. If the voter provides the necessary information to the board of elections not later than the seventh day after the day of the election and the ballot is not successfully challenged on another basis, the voter’s ballot shall be processed and counted in accordance with this section.”

Which means I’d be notified if my ballot is rejected, and I could go to the Board of Elections within seven days of the election to provide whatever sort of identification they need to be satisfied. A total of fifteen states provide a remediation path for signature challenges — details for those states at https://www.ncsl.org/research/elections-and-campaigns/vopp-table-15-states-that-permit-voters-to-correct-signature-discrepancies.aspx

2020 Presidential Debate Number One

Speculation — Why he didn’t release his taxes

I’ve long speculated that Trump doesn’t release his taxes because beyond paying zero dollars (which everyone pretty much expects), he’s taking refundable deductions and having the government pay him. Well, the NYTimes has finally gotten access to years of returns for Trump and his businesses … and I’ve got a new hypothesis. It was only time before someone with access to Trump’s taxes sent that info to reporters. Had he stayed a private citizen, no one would have cared. And people who could have accessed the documents wouldn’t have bothered — they weren’t important.

The “loss” he claimed and carried back to request a 70 million dollar refund is questionable. If he got interest in the reformed company, he didn’t actually walk away from the investment. Before the tax returns were publicized, no one knew that the details of the subsequent transactions were of interest. Now that it’s public? Someone has access to information that’s pertinent to the IRS investigation. It’s only a matter of time before those details are splashed across some news paper’s page.

On Taxes and Businesses

I expect a lot of hype about how little Trump paid in taxes — and, yeah, it really sucks that someone is able consider private planes, meals, club memberships, car leases, etc to be a tax-deductible business expense. One of my first introductions to the working world was a privately-held company. I was the IT department, and one of my jobs was to move data from the old systems (mainframe for order management, database for inventory, and paper ledger for accounting) into the new all-in-one business management platform. Which meant I not only had access to all of the company’s accounting, but that I had to read through it all to get the information typed into the new platform. The company owner’s plane was owned by the business, so the hangar and maintenance was a business expense. He’d hire time in the plane for person use, but he got a really good discount from his company’s transportation service. Same for the company car he drove. And the country club membership — that’s where he’d meet with clients to solicit business, after all. Food and drink at those client meetings were business expenses too. It was all perfectly legal and designed both to maximize the owner’s enjoyment of life and the minimize the business’s profits. As a broke out-of-college kid, it seemed awfully unfair that the rich old dude was able to eat every day and avoid paying some taxes in doing so but the huge chunk of my paycheque that went to various taxes meant I had some rice to eat that day.

There were subordinate companies that paid consulting fees back to the main company to zero out any profits they made. And that parent company had a bunch of “business expenses” that minimized their profits. Ideally, the CFO told me, you’d net zero every year (or even have a paper loss) and not have to send the federal government anything in business taxes. Which I get — people shop around for the best price, find coupons and promo codes … you try to get the best deal. And, if the legal structure allows you to do so, why wouldn’t you avoid paying taxes altogether?

I’ve heard people say that a business needs to show a profit every ten years — that’s not true. If you don’t show a profit once in a ten year period, you may be asked to prove to the IRS that it’s a legit business. I come across this in the soap-making community — buying stuff for my soap-making hobby is not tax deductible even if I construct a business entity under which to make those purchase. Even if I happen to sell a few bars of soap to friends and neighbors. But if you’re advertising your product, going out to craft fairs and selling your soap … you provide the IRS evidence of your attempts to sell your product and you could be losing money every year for decades and still write off business expenses.

And the tax code is designed to encourage businesses to minimize their net — investing in your business offsets profit too. It’s one of the biggest problems I had with the interaction Obama had with Joe the not-a-plumber. If you buy a plumbing business that grosses a million dollars a year? You hire another plumber, buy another truck … you invest in a new tool that lets you offer more services. You spend some of that money and don’t have to pay taxes on it. Well, that hiring and purchasing also improves the country’s economy.

Ohio Remote Ballot Marking System Expansion Request

Email to Secretary of State DeRose, my Ohio State Senator, and my Ohio State Representative:

There appears to be a remote ballot marking system available if you have a qualifying disability under ADA. I would like to see the availability of this 11-G absentee request be expanded to anyone with COVID-like symptoms or asked to quarantine for potential exposure. This would allow such individuals to remotely mark their ballot and ensure their vote is counted. It’s not the resource strain that offering in-person pick-up akin to RC 3509.08 would be, and it allows people to ensure their vote is counted without risking heir health or the health of community members.

Ohio Absentee Balloting Nuances

Ohio RC 3509.05 lists approved relatives who are able to deliver a ballot on behalf of another individual (spouse of the elector, the father, mother, father-in-law, mother-in-law, grandfather, grandmother, brother, or sister of the whole or half blood, or the son, daughter, adopting parent, adopted child, stepparent, stepchild, uncle, aunt, nephew, or niece of the elector). So I cannot deliver the ballot for my neighbors, but their kids can. That’s a firm ‘no’ on dropping off ballots for anyone who is not related to you a way listed in RC 3509.05 at the Board of Elections. I won’t get into the probability of enforcement — that’s something an individual would need to decide for themselves. If the ballot isn’t getting submitted any other way, might be worth the risk having an unauthorized person drop it off and having your vote invalidated. To me, the law precludes a mass effort to get people driving around and collecting ballots for a neighborhood and dropping those off at the Board of Elections. Same with dropping off bunch of ballots over at the Post Office closest to the Board of Elections — “elector shall mail” isn’t the same as “elector shall cause to be mailed”.

Ohio RC 3509.08 option where the Board of Elections drops off the ballot and picks it up is currently only for those confined to nursing homes and jails. So if you know someone who is in a nursing home or jail … they totally can request the Board of Elections bring them a ballot, wait while it is filled out {even fill out the ballot if the person is unable to do so themselves — I’m thinking of my great-grandmother who could barely write an “X” in the signature line near the end of her life} and bring that ballot back to be counted. That’s a pretty awesome level of service. And I get that they don’t have anywhere near enough staff to broaden that service.

What you *can* do is drop off a ballot for parents, grandparents, aunts/uncles, siblings, children, and nieces/nephews. So if you’ve got family members who don’t have time/resources/mobility/health to drop off the ballots in person, you can certainly collect *their* ballots and drop them off at the appropriate Board of Elections.

There also appears to be a remote ballot marking system available if you have a qualifying disability under ADA. (Cuyahoga and Medina). I’m e-mailing DeRose’s office and my local Ohio Congresspersons (“Member Search” in the lower left-hand corner of http://www.ohiohouse.gov/ for the House, https://www.ohiosenate.gov/senators/district-map for the Senate) asking them to expand the availability of the 11-G absentee request. Anyone with COVID-like symptoms or asked to quarantine for potential exposure should be allowed to remotely mark their ballot too. It’s not the resource strain that offering in-person pick-up would be, and it allows people to ensure their vote is counted without risking heir health.

And if you request an absentee ballot but decide to vote in person instead, you can. You’ll need to submit a provisional ballot — this is to ensure you don’t both return an absentee ballot and vote in person.

On Biden

It’d be great if some Biden supporters put effort into understanding what progressives want and articulated how Biden produces actual progress toward that goal (not ‘we will get back to where we were in 2010’). Because “you have to vote for him or fracking fluid will be dumped into the river” and “Trump is going to nominate reanimated Scalia and nominate the first zombie-American SCOTUS jutice”… probably enough to get me to check the box they want checked, I still want an “Any Competent Adult 2020” sign because *that’s* what I’m voting for. Not Biden. Literally whatever halfway competent >=35 year old native-born citizen the Dem’s put on the ballot.